NIRSAL loan is a great way to get financial assistance for your small business. However, it is important to know how to check Nirsal loan with BVN before you apply. This will help you make sure that you are eligible for the loan and that you will not have any problems with your application.

Contents

How to get your BVN to check Nirsal loan approval with BVN number

In order to check your Nirsal loan with BVN, you will need to follow these steps:

1. Log in to the official website of the Bank Verification Number (BVN) using your unique ID and password.

2. Select the “Loan” tab from the top menu.

3. Enter your loan amount and BVN in the required fields.

4. Click on the “Check Status” button to know if your loan has been approved or not.

How to check if you’re eligible for a NIRSAL loan

If you’re looking to apply for a NIRSAL loan, the first step is to check if you’re eligible. There are a few criteria you’ll need to meet in order to be eligible for a NIRSAL loan:

- You must be a Nigerian citizen

- You must be 18 years of age or older

- You must have an active Bank Verification Number (BVN)

- You must have an account with a Nigerian bank

Also Read: How to Make Money Online in Nigeria in Two Hours

If you meet all of the above criteria, you can move on to the next step of applying for a NIRSAL loan.

What to do if you’re not eligible for a Nirsal loan

If you’re not eligible for a loan, there are still a few things you can do. You can try to improve your credit score so that you’ll be more likely to be approved for a loan in the future. You can also look into other financing options, such as grants or loans from family and friends. Whatever you do, make sure you keep track of your finances so that you can get the best loan possible when you become eligible.

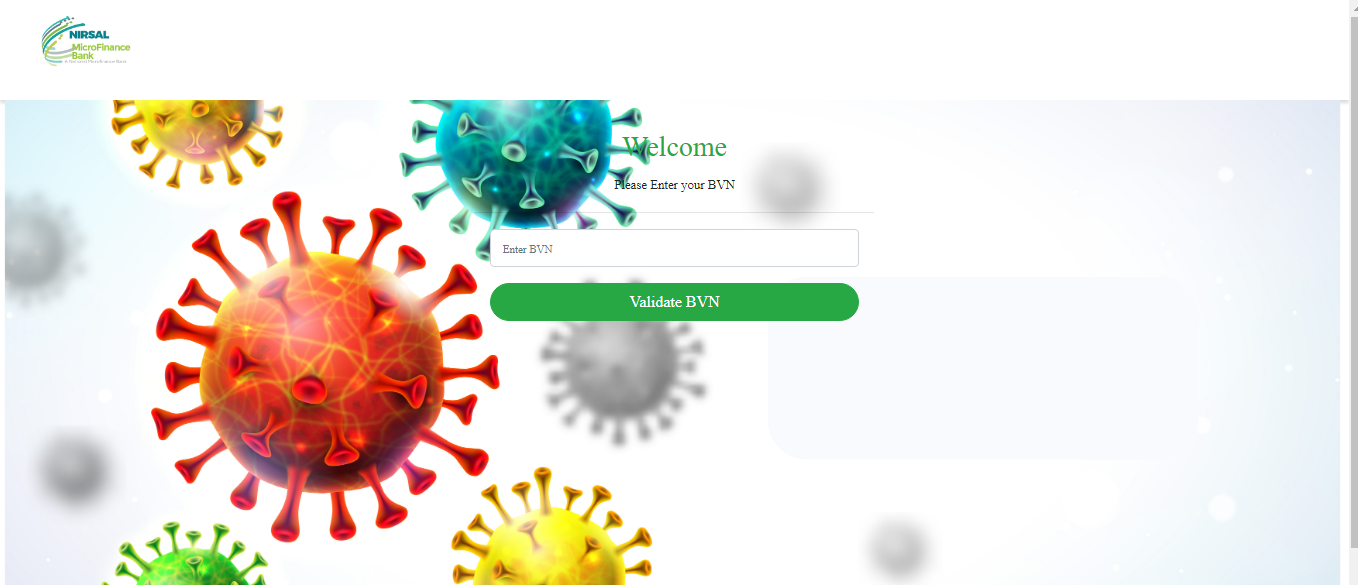

How to apply for covid-19 loan in Nigeria via Nirsal loan

NIRSAL loan applications are done online through the NIRSAL MFBs website. To apply for a loan, you will need to create an account and provide some personal information, including your BVN. Once you have created an account, you can log in and fill out the application form.

The application process is simple and straightforward, and should only take a few minutes to complete. After you have submitted your application, you will need to wait for a decision from the NIRSAL MFB. If your application is approved, you will be able to access the funds within a few days.

Final thoughts on Nirsal covid-19 loan BVN check

If you’re thinking about applying for a NIRSAL loan, it’s important to check your BVN first. This will give you an idea of whether or not you’re eligible for the loan and what interest rate you’ll be charged. Checking your BVN is easy to do online and only takes a few minutes. Once you have your BVN, you can apply for a NIRSAL loan with confidence, knowing that you’re getting the best possible deal.